What You Need to Know Before You Purchase Reverse Mortgage

What You Need to Know Before You Purchase Reverse Mortgage

Blog Article

Step-By-Step: Exactly How to Purchase a Reverse Home Loan With Confidence

Browsing the intricacies of buying a reverse home mortgage can be overwhelming, yet a methodical approach can empower you to make informed decisions. It starts with analyzing your eligibility and understanding the subtleties of various loan alternatives offered out there. Engaging with reputable lenders and comparing their offerings is crucial for safeguarding positive terms. The process does not end there; cautious interest to paperwork and compliance is essential. As we check out each action, it becomes noticeable that self-confidence in this financial choice pivots on complete preparation and informed selections. What follows in this necessary trip?

Understanding Reverse Home Loans

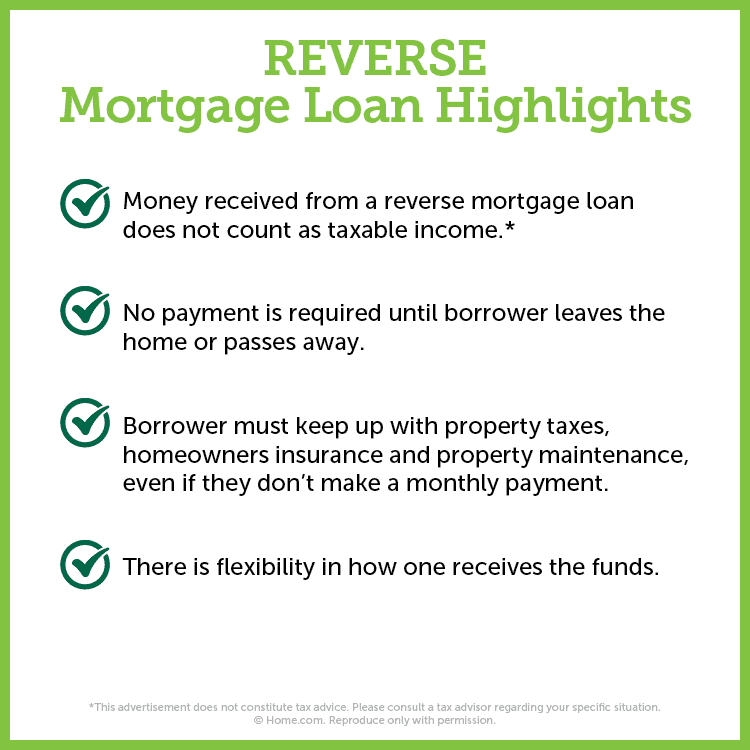

The key mechanism of a reverse home mortgage involves loaning versus the home's worth, with the finance amount enhancing with time as passion accumulates. Unlike traditional home loans, debtors are not needed to make monthly payments; rather, the financing is paid off when the home owner offers the home, moves out, or passes away.

There are two primary kinds of reverse home loans: Home Equity Conversion Home Mortgages (HECM), which are government insured, and exclusive reverse mortgages used by private lending institutions. HECMs commonly provide greater security due to their regulative oversight.

While reverse home mortgages can offer financial alleviation, they also include prices, consisting of source charges and insurance policy premiums. It is important for possible borrowers to totally recognize the terms and effects before continuing with this financial alternative.

Examining Your Eligibility

Qualification for a reverse home mortgage is mainly determined by several key aspects that potential consumers should take into consideration. Firstly, applicants must be at the very least 62 years of age, as this age need is readied to make certain that borrowers are coming close to or in retirement. In addition, the home needs to act as the customer's key residence, which means it can not be a holiday or rental property.

One more essential facet is the equity setting in the home. Lenders generally require that the customer has a sufficient amount of equity, which can affect the amount readily available for the reverse home loan. Typically, the much more equity you have, the bigger the financing quantity you might receive.

Additionally, potential borrowers should show their ability to meet financial obligations, consisting of residential or commercial property tax obligations, homeowners insurance policy, and maintenance expenses - purchase reverse mortgage. This evaluation often consists of an economic evaluation performed by the loan provider, which examines earnings, credit rating, and existing debts

Finally, the building itself need to meet particular criteria, including being single-family homes, FHA-approved condos, or specific manufactured homes. Recognizing these elements is vital for figuring out eligibility and planning for the reverse mortgage process.

Researching Lenders

After determining your qualification for a reverse home loan, the next step includes investigating loan providers that use these financial products. It is critical to determine trusted loan providers with experience in reverse home loans, as this will ensure you get trustworthy support throughout the procedure.

Begin by evaluating loan provider credentials and certifications. Search for loan providers that are members of the National Opposite Home Mortgage Lenders Organization (NRMLA) and are accepted by the Federal Housing Management (FHA) These associations can indicate a dedication to ethical methods and compliance with industry criteria.

Reading client testimonials and testimonies can supply insight right into the lender's reputation and customer support quality. Sites like the Better Service Bureau (BBB) can also supply scores and complaint backgrounds that may assist educate your choice.

In addition, talk to monetary experts or housing therapists that focus on reverse home loans. Their expertise can aid you browse the options offered and suggest trustworthy lending institutions based upon your special economic circumstance.

Comparing Funding Options

Contrasting lending options is a vital action in safeguarding a reverse home loan that aligns with your financial objectives. When assessing numerous reverse home mortgage items, it is necessary to think about the details features, expenses, and terms connected with each option. Beginning by reviewing the sort of reverse home loan that ideal matches your demands, such as Home Equity Conversion Home Mortgages (HECM) or proprietary finances, which may have various qualification standards and advantages.

Next, take note of the passion click here for more prices and charges connected with each lending. Fixed-rate fundings provide stability, while adjustable-rate choices might supply reduced preliminary prices however can change in time. Additionally, consider the in advance costs, consisting of mortgage insurance costs, origination fees, and closing prices, as these can significantly influence the overall expense of the finance.

Additionally, assess the repayment terms and exactly how they line up with your lasting financial technique. When the financing have to be paid off is crucial, understanding the effects of how and. By thoroughly contrasting these elements, you can make an educated decision, guaranteeing your option supports your monetary wellness and offers the safety and security you look for in your retired life years.

Finalizing the Acquisition

Once you have actually carefully examined your options and picked one of the most ideal reverse mortgage item, the next action is to wrap up the purchase. This procedure involves several critical steps, making sure that all essential paperwork is accurately finished and sent.

First, you will require to gather all needed documents, consisting of evidence of revenue, real estate tax declarations, and property owners insurance documents. Your lender will certainly offer a listing of details papers required to facilitate the approval process. It's essential to offer exact and complete info to stay clear of hold-ups.

Following, you will undertake an extensive underwriting process. Throughout this phase, the lender will assess your monetary scenario and the value of your home. This might include a home appraisal to determine the residential property's market worth.

As soon as underwriting is full, you will obtain a Closing Disclosure, which describes the last terms of the loan, consisting of charges and rate of interest. Review this document very carefully to make certain that it lines up with your expectations.

Conclusion

In verdict, browsing the process of purchasing a reverse home mortgage needs an extensive understanding of eligibility standards, persistent study on loan providers, and careful comparison of finance alternatives. By methodically adhering to these actions, people can make educated decisions, making sure that the picked home mortgage aligns with economic goals and requirements. Eventually, an educated method promotes confidence in securing a reverse home mortgage, supplying economic stability and support for the future.

Look for lenders who are participants of the National Opposite Mortgage Lenders Organization (NRMLA) and are approved by the Federal Housing Administration (FHA)Contrasting lending alternatives is a crucial action in securing a reverse home mortgage that lines up with your financial objectives (purchase reverse mortgage). Start by examining the kind of reverse home loan that best fits your requirements, such as Recommended Site Home Equity Conversion Home Loans (HECM) or proprietary loans, which may have different eligibility requirements and benefits

In final thought, browsing pop over to these guys the process of buying a reverse home loan calls for a thorough understanding of eligibility criteria, attentive research study on lenders, and cautious contrast of funding alternatives. Ultimately, a knowledgeable method cultivates confidence in protecting a reverse mortgage, giving economic security and assistance for the future.

Report this page